Back to blog

Multi-Channel Phishing Defense: Vishing & Deepfake Tools

Written by

Brightside Team

Published on

Nov 14, 2025

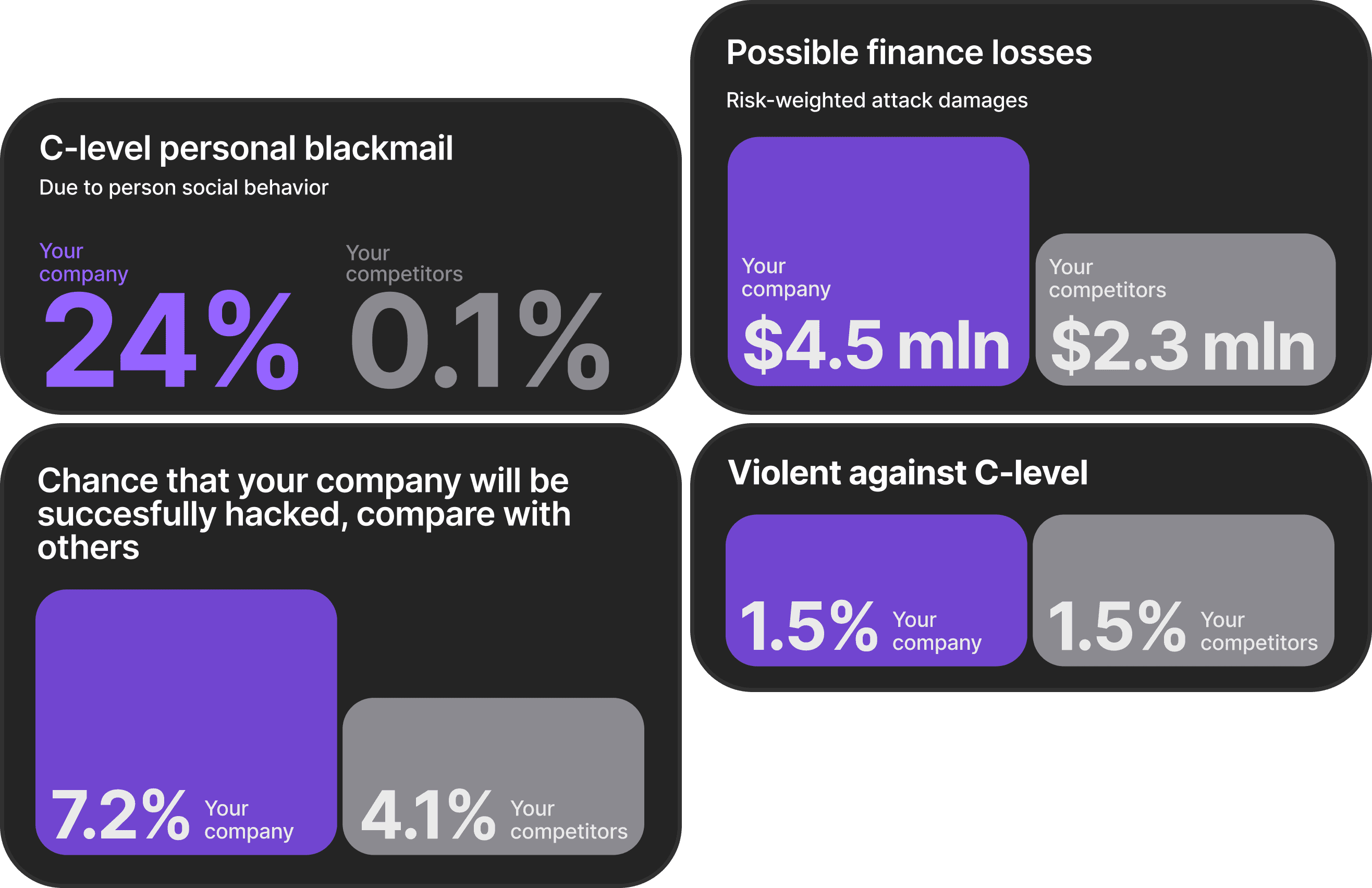

Your finance director receives an email about an urgent vendor payment change. Nothing unusual. But then her phone rings. The voice on the other end sounds exactly like your CFO, down to the slight pause before important numbers and that characteristic throat-clear. She approves the transfer. Thirty minutes later, you discover your company just lost $2.3 million to a coordinated attack that started with a simple email and ended with a perfectly cloned voice.

This isn't a hypothetical scenario anymore. Multi-channel phishing attacks now blend email, voice calls, and synthetic media into coordinated campaigns that exploit the same employee across multiple touchpoints. While your security team focused on email filters, attackers moved the conversation to your phones and video calls. They're using AI to personalize messages at scale, clone executive voices from short audio samples, and create deepfakes that fool most viewers.

The financial stakes are staggering. IBM's 2024 Cost of a Data Breach Report shows the average breach costs $4.88 million, with phishing-related incidents consistently ranking among the most expensive. Business Email Compromise alone generated $2.77 billion in losses during 2024. The question isn't whether to invest in multi-channel phishing defense. It's whether you can afford not to.

Understanding Multi-Channel Phishing Fundamentals

Clarifying Core Concepts and Terminology

Let's start with the basics. Phishing is any attempt to trick someone into giving up credentials, transferring money, or clicking malicious links through deceptive messages. You've seen the classic version in your inbox: emails claiming to be from your bank, shipping company, or IT department.

Spear phishing takes this further by targeting specific individuals with personalized information. Instead of "Dear Customer," the email uses your name, mentions your recent project, and references people you actually work with. Business Email Compromise (BEC) represents the most financially devastating variant, where attackers impersonate executives or vendors to authorize fraudulent transactions. The average BEC incident in 2024 cost organizations approximately $129,000 in direct losses (calculated from $2.77 billion total losses divided by 21,442 incidents, though individual cases range from thousands to millions).

Vishing means voice phishing, where attackers call you directly. They might claim to be from IT support, your bank's fraud department, or a vendor following up on that email you just received. The convergence with email makes vishing particularly effective because the call "confirms" the email or vice versa.

Deepfake attacks use AI-generated synthetic audio or video to impersonate someone. Modern tools can clone voices from relatively short audio samples, though quality varies significantly based on source material and use case. An attacker records your CEO speaking at a conference, feeds it into an AI model, and can then generate audio in that executive's voice. Video deepfakes work similarly but require more source material and processing power.

Why Attackers Combine Email, Voice, and Deepfake Channels

Single-channel attacks face a trust problem. You might be skeptical of an unexpected email. But what if that email is followed by a phone call that references the message? The multi-touch approach dramatically increases trust while lowering your natural defenses.

Attackers now automate this personalization with AI. They gather intelligence from LinkedIn, data breach dumps, and social media. Then they use language models to craft emails that mention your specific projects, use your company's terminology, and mirror internal communication styles. The same AI personalizes the follow-up vishing call, ensuring consistency across channels.

Research confirms this approach works. Vishing attacks surged 442% between 2024 and 2025, representing a dramatic escalation in both volume and sophistication. When employees receive an email and then a "confirming" call, they rarely stop to verify through alternative channels. The coordinated timing creates urgency that bypasses rational decision-making.

Mapping the Anatomy of a Modern Multi-Channel Phishing Campaign

Following a Real-World Attack Narrative

Let's walk through a realistic scenario targeting your finance team:

Stage 1: Reconnaissance

Attackers scan LinkedIn for your finance director's profile, noting she recently posted about quarter-end closing. They search data breach databases and find her work email appeared in three separate leaks over the past two years. Social media reveals she's active in a CFO network group and recently attended an industry conference.

Stage 2: Email Pretext

An email arrives from what appears to be a known vendor, using a slightly misspelled domain. The message references real past transactions and mentions "updated banking details for Q4 payments." It's professionally written with perfect grammar, uses proper terminology, and even includes an invoice number from a legitimate prior transaction.

Stage 3: Voice Confirmation

Thirty minutes later, a call comes in. The caller ID shows your CFO's mobile number (spoofed using readily available tools). The voice sounds like your CFO, mimicking familiar speech patterns. "Did you see my email about the Acme payment? I need you to process this today before the wire cutoff." The urgency, the familiar-sounding voice, and the email reference all reinforce each other.

Stage 4: Deepfake Escalation (Advanced Campaigns)

In sophisticated attacks, when the target hesitates, attackers escalate to a video call. A deepfake video shows someone appearing to be your CFO in their office, with background details scraped from social media. This final layer of "proof" can overcome remaining skepticism.

Identifying Typical Targets and Decision Points

Not everyone in your organization faces equal risk. Finance, procurement, and executive assistants sit at critical decision points where they can authorize payments, grant access, or share sensitive information.

These roles face unique pressure:

Time sensitivity: Payment deadlines, vendor contracts, and urgent requests

Authority dynamics: Direct requests from executives or senior leaders

Process familiarity: Routine approval flows that attackers can mimic

Multi-channel contact: Regular communication via email, phone, and messaging

The attack chain can be interrupted at several points. After the initial email, a well-trained employee might verify through alternative channels before acting. When the vishing call comes, they could use a call-back number from the company directory rather than the displayed caller ID. Building these verification reflexes requires more than annual training.

Quantifying the Business Risk from Email, Vishing, and Deepfake Attacks

Connecting Phishing-Driven Breaches to Hard Financial Impact

IBM's 2024 Cost of a Data Breach Report provides concrete numbers that should concern every security leader. The average data breach costs $4.88 million when you account for detection, response, notification, and recovery costs. Business Email Compromise attacks alone generated $2.77 billion in losses during 2024 across 21,442 reported incidents. Investment fraud enabled by phishing tactics cost another $6.57 billion.

These figures only capture reported losses to the FBI. The actual financial impact includes:

Direct theft: Fraudulent wire transfers and unauthorized payments

Recovery costs: Incident response, forensic investigation, and legal fees

Regulatory penalties: GDPR, HIPAA, and other compliance violations

Reputation damage: Customer attrition and partner relationship strain

Productivity loss: Business disruption during investigation and recovery

Organizations implementing comprehensive security measures including AI-powered detection and automated response capabilities have shown significant cost advantages in breach scenarios, though specific ROI depends on numerous factors including organization size, industry, and threat landscape.

Why Human Error Remains the Dominant Root Cause

Technical controls can block many attacks. But humans remain a significant vulnerability. Research consistently shows that the majority of successful breaches involve some human element, from clicking malicious links to approving fraudulent requests under pressure.

Why does this persist despite years of awareness training?

Psychological exploitation: Attackers manipulate fear, urgency, authority, and trust. When someone appearing to be your boss calls with an urgent request, your brain's response to authority figures can override security protocols.

Cognitive overload: Finance professionals juggling dozens of legitimate payment requests can't deeply analyze every communication. Attackers exploit this workload by timing attacks during busy periods like quarter-end.

Traditional training limitations: Annual security awareness training shows minimal effectiveness in changing actual behavior. UC San Diego research involving 19,500 employees found that employees who had just completed training performed no better in realistic phishing exercises than those who hadn't received training in over a year.

The critical distinction? Static training delivers information. Realistic simulations test behavior under pressure. When someone receives immediate feedback after failing a simulation that felt genuinely urgent, that emotional experience creates stronger memory formation than watching a video about phishing red flags. This explains why research shows embedded training with immediate feedback can reduce susceptibility by up to 52%, while traditional annual training shows virtually no impact.

Designing a Multi-Channel Phishing Simulation Strategy

Defining the Goals of Multi-Channel Phishing Programs

What are you actually trying to achieve with phishing simulations? If your answer is "compliance" or "checking a box," you're missing the point.

Effective programs pursue specific, measurable objectives:

Reduce failure rates across email, vishing, and deepfake scenarios

Improve reporting behavior so employees forward suspicious messages quickly

Test resilience to complex attacks that span multiple channels

Validate response protocols for high-risk scenarios like payment fraud

Identify process vulnerabilities that training alone can't fix

Your simulation strategy should align with actual business risks. If your crown jewels are customer payment data, design scenarios around credential theft and payment fraud. If intellectual property is your concern, focus on executive impersonation and data exfiltration pretexts.USPs-of-Brightside.txt

The metric that matters isn't just how many people fall for simulations. It's how behavior changes over time, how quickly employees report suspicious activity, and whether you're identifying systemic process gaps that need technical controls rather than more training.

Prioritizing Email Phishing, Vishing, and Deepfake Use Cases

You can't simulate everything at once. Start with high-fidelity email phishing that mirrors real attack patterns. Focus on tactics targeting your industry and roles. Financial services should emphasize regulatory pretexts and compliance urgency. Healthcare should test scenarios around patient data and insurance verification.

Layer vishing simulations for roles that handle sensitive transactions. These don't need to be frequent, but they should be realistic:

IT support pretexts: "We're seeing unusual activity on your account"

Executive requests: "I'm in a meeting and need you to process this quickly"

Vendor follow-ups: "Confirming the payment details I emailed earlier"

Introduce deepfake simulations carefully. These are resource-intensive and should be reserved for the highest-risk scenarios. Consider them for CFOs' executive assistants, treasury staff, and anyone with significant payment authorization authority.

Consider this progression:

Months 1-3: Baseline email phishing across all employees

Months 4-6: Targeted spear phishing for finance and procurement

Months 7-9: Vishing simulations for payment authorization roles

Months 10-12: Limited deepfake tests for executive-level targets

This phased approach builds capability systematically while maintaining engagement. Frequent simulations work for some organizations, though research on optimal timing remains limited. The key is balancing exposure with reflection time and avoiding pattern recognition where employees simply learn to spot "simulation Thursdays" rather than developing genuine vigilance.

Integrating OSINT and Personalization into Simulations

Using Real-World Exposure to Shape Realistic Scenarios

Generic phishing simulations using obvious grammar errors and suspicious links don't prepare employees for sophisticated attacks. You need to mirror how real attackers operate, which starts with reconnaissance.

Open Source Intelligence (OSINT) involves gathering publicly available information from LinkedIn, company websites, data breach databases, and social media. This is exactly what attackers do before launching targeted campaigns. Using similar techniques (ethically and transparently) for simulation creates scenarios that employees find believable because they mirror actual exposure patterns.

For example, if an employee's email appeared in a known data breach and they frequently post about specific technologies, a realistic simulation might reference both elements. The personal relevance makes the scenario more effective than generic templates.USPs-of-Brightside.txt

Brightside AI's approach exemplifies this principle. The platform maps employees' complete digital presence across six categories: personal information, data leaks, online services, personal interests, social connections, and locations. This visibility enables simulations that reference actual exposed data, helping employees understand how their digital footprint could be weaponized in real attacks.USPs-of-Brightside.txt+1

Balancing Realism with Psychological Safety and Employee Trust

High-fidelity simulations raise an important question: when does "realistic" become counterproductive?

You're not trying to trick people or create gotcha moments. The goal is building genuine resilience while maintaining trust. Getting this balance right requires several considerations:

Supportive responses: When someone fails a simulation, the immediate response should be educational, not punitive. Shame drives people to hide mistakes rather than report real attacks. The most effective programs frame simulations as practice opportunities where failure is part of learning.

Technical safeguards as primary defense: Simulations should identify where you need better technical controls, not just "better employees." If people routinely fail payment fraud simulations, you might need mandatory two-person approval above certain thresholds or callback verification requirements built into your payment workflow. This reduces dependence on perfect human judgment under pressure.

Avoiding simulation gaming: As employees experience more simulations, some learn to recognize patterns rather than developing genuine awareness. Varying cadence, mixing difficulty levels, and ensuring scenarios evolve with actual threat patterns helps maintain effectiveness. This habituation challenge means simulations work best as one component of defense-in-depth, not your sole strategy.

Operating and Measuring Multi-Channel Phishing Tools

Establishing Metrics That Matter to Leadership

Most organizations measure the wrong things. Training completion rates and initial click percentages tell you little about actual risk reduction.

Focus on metrics that connect to business outcomes:

Metric Category | What to Measure | Why It Matters |

|---|---|---|

Failure Rates | Percentage clicking, entering credentials, or approving fraudulent requests | Direct measure of vulnerability at a point in time |

Behavioral Trajectory | Failure rate changes over 6-12 months | Shows whether program creates lasting improvement |

Reporting Behavior | Time from simulation to report, percentage reporting | Indicates security culture strength |

Channel-Specific Risk | Failure rates for email vs. vishing vs. deepfake | Shows where to focus resources |

Role-Based Vulnerability | Failure rates by department and position | Identifies high-risk groups needing additional controls |

Be cautious about oversimplified ROI calculations. While it's tempting to claim that a 20-point reduction in failure rates will prevent X number of incidents worth $Y, the relationship between simulation performance and real attack outcomes is complex. Someone might fail a low-stakes simulation but perform differently when actual money is at risk. Conversely, employees who pass simulations might still fall victim to attacks that use different tactics or timing.

A more honest approach: track your metrics, identify trends, and use them to guide resource allocation and technical control implementation. Report improvements as risk indicators rather than guaranteed prevented losses.

Aligning Simulations with Incident Response and Zero Trust

Phishing simulations shouldn't exist in isolation. They should stress-test your broader security architecture.

Zero Trust integration: Use simulation results to inform adaptive access policies. This isn't about punishing employees who fail, but about recognizing that demonstrated vulnerability should trigger additional safeguards. Someone who struggles with payment fraud simulations might require stepped-up verification for transactions above certain thresholds.

Incident response testing: When a vishing simulation succeeds, does the employee know who to contact? Do they have a direct channel that bypasses normal queues? Does your SOC have playbooks for social engineering attempts? Simulations reveal these gaps.

Process refinement and technical controls: Simulations reveal workflow vulnerabilities that training can't fix. If finance staff routinely approve payments via phone at executives' request because your systems make callback verification inconvenient, you have a process problem. The solution might be mandatory two-person approval, automated callback systems, or behavioral analytics that flag unusual payment patterns. These technical safeguards reduce dependence on human judgment under pressure.

Top 5 Multi-Channel Phishing Test Tools

Framing the ROI of Multi-Channel Phishing Tools

Before diving into specific platforms, let's establish the financial context. IBM's research on data breach costs shows significant variations based on organizational security capabilities. When you consider that Business Email Compromise incidents cost organizations $2.77 billion collectively in 2024, with individual cases ranging from small losses to multi-million dollar frauds, the case for sophisticated phishing defense becomes clear.

Effective phishing simulation programs reduce risk by identifying vulnerable workflows, building employee awareness through realistic practice, and revealing where technical controls are needed. The key is choosing platforms that test actual behavior under realistic pressure rather than just generating training completion statistics.

Brightside AI: OSINT-Powered Multi-Channel Simulations with Active Risk Reduction

Brightside AI fundamentally reimagines phishing simulation by combining realistic multi-channel testing with active attack surface reduction. This Swiss cybersecurity platform doesn't just measure vulnerability, it helps you systematically reduce it.

What sets Brightside apart is its complete multi-channel simulation suite. The platform delivers realistic email phishing simulations, AI-powered vishing simulations, and deepfake scenarios, so teams can practice handling the same coordinated attacks they'll face in the real world. OSINT-powered personalization mirrors actual attacker reconnaissance, crafting scenarios employees find believable because they reference their real exposure.

Four capabilities make Brightside especially powerful:

Multi-channel simulations in one platform

Use pre-made templates by role and attack type, or AI-generated spear‑phishing based on real exposure data. Target the whole company, specific functions like finance or HR, or individual high-risk users. Brightside offers email, deepfakes and voice phishing simulations.Hybrid protection model for org and individuals

Each employee gets a personal portal showing their risk levels across six categories, plus the Brighty privacy companion to guide remediation. At the same time, security teams see aggregate dashboards with simulation stats, vulnerability scores, and identified security champions, while employees keep control over detailed personal data.Privacy-preserving Swiss architecture with clear metrics

Employees control their detailed exposure data, while admins see aggregated trends: team vulnerability, simulation performance, and exposed data counts. Individual vulnerability scores based on simulations, digital footprint size, and training progress feed into board-ready reporting that expresses human risk in business terms.

When employees see how their own leaked credentials and public posts could power those pretexts, awareness becomes personal and memorable. Instead of resenting “gotcha” tests, they get tools to actively reduce their risk and become security champions for the organization

KnowBe4: Established Platform with Extensive Template Library

KnowBe4 is probably the most recognized name in phishing simulation and security awareness training. The platform offers extensive template libraries, culture assessments, and automated enrollment into training after failed simulations.

Strengths that have built KnowBe4's market position:

Large-scale deployment experience: Organizations running sustained KnowBe4 programs can benchmark against industry data showing improvement trends over time.

Report phishing integration: Add-on tools help security teams triage employee-reported suspicious emails, creating a feedback loop.

Limitations for advanced multi-channel threats:

Multi-channel coordination requires manual setup, as the platform primarily focuses on email simulations

Some users report template realism challenges for sophisticated scenarios

Content fatigue can develop in long-running programs where employees recognize simulation patterns

KnowBe4 works well for organizations starting security awareness programs or those needing scalable email-focused training. Multi-channel vishing and deepfake simulations require more operational effort to implement effectively.

Proofpoint Security Awareness Training: Threat Intelligence Integration

Proofpoint leverages its massive email security infrastructure to inform security awareness. The platform analyzes billions of messages to identify current attack trends and incorporates those patterns into simulations.

Strengths for threat-informed training:

Adaptive learning and risk identification: The platform identifies high-risk individuals receiving disproportionate targeting and adjusts training accordingly.

Current threat intelligence: Simulations automatically update to reflect attack campaigns targeting specific industries.

Operational considerations:

Heavier configuration requirements compared to simpler platforms

Multi-channel simulation capabilities for vishing and deepfake scenarios require additional components or custom implementation

Often bundled with broader Proofpoint products, which may affect standalone economics

Proofpoint makes sense for organizations already using Proofpoint email security who want integrated awareness programs. For comprehensive multi-channel testing including vishing and deepfake simulations, supplementary tools may be needed.

Hoxhunt: Behavioral Psychology and Micro-Learning

Hoxhunt takes a behavioral psychology approach with frequent, bite-sized simulations and immediate feedback. The platform aims to build reporting habits through positive reinforcement rather than extensive training modules.

Strengths for engagement:

Continuous reinforcement through frequent micro-simulations that maintain ongoing awareness.

Personalized difficulty progression based on individual user behavior.

Coverage considerations:

Vishing simulation capabilities less developed than email-focused competitors

Deepfake simulation support limited

May require supplementation for organizations facing sophisticated nation-state or organized crime threats

Hoxhunt excels at building security-aware culture through positive reinforcement. Organizations needing comprehensive multi-channel capabilities including advanced vishing and deepfake simulations should evaluate coverage carefully.

SoSafe: European Focus with Multi-Channel Coverage

SoSafe brings European privacy sensibilities to security awareness training, with particular attention to GDPR and regional compliance frameworks.

Strengths for European operations:

Regional compliance focus with content designed for European regulatory environments.

Multi-channel coverage addressing vishing and social engineering over collaboration platforms.

Market position considerations:

Smaller presence outside Europe

Deepfake simulation capabilities still developing

Program configuration requires careful balance to maintain engagement without fatigue

SoSafe works well for European organizations prioritizing privacy-conscious security awareness with multi-channel breadth. Global enterprises should evaluate regional focus alignment with their operating model.

Start your free risk assessment

Our OSINT engine will reveal what adversaries can discover and leverage for phishing attacks.

FAQs About Multi-Channel Phishing Simulations

What's the Goal of Multi-Channel Phishing Simulations in Modern Security Programs?

The primary goal is straightforward: test how employees actually respond to sophisticated attacks that span email, phone, and synthetic media under realistic conditions.

Traditional awareness training teaches theoretical knowledge. Multi-channel simulations reveal whether employees can resist sophisticated social engineering when it matters. When your "CFO" calls during quarter-end with an urgent payment request that references an earlier email, will your finance team use callback verification or comply immediately?

Well-designed programs identify specific vulnerabilities that need addressing. If your procurement team routinely fails vishing simulations that reference prior email threads, you've identified a process vulnerability. The solution might be technical controls like mandatory callback requirements or two-person approval, not just more training.

The goal isn't catching people making mistakes. It's understanding where your organization is vulnerable so you can systematically reduce that risk through targeted interventions, process improvements, and technical controls that don't depend on perfect human judgment.

How Often Should Organizations Run Phishing, Vishing, and Deepfake Simulations?

Research on optimal simulation frequency remains limited, but practical experience suggests balancing exposure with reflection time. Many organizations find success with varied cadence based on role and risk.

Consider this risk-based approach:

Email phishing: Monthly or bi-monthly for general population, more frequent for high-risk roles

Vishing: Quarterly for finance and executive support roles handling sensitive transactions

Deepfake simulations: Semi-annually or annually for payment authorization roles only

The key is maintaining unpredictability. If employees know simulations always arrive on specific days, they'll be extra vigilant on those days and relaxed otherwise. Randomize timing within your schedule.

Balance frequency with fatigue and habituation risks. Too frequent and employees either become resentful or learn to recognize simulation patterns rather than developing genuine awareness. Too infrequent and lessons fade between exercises. Leave space between simulations for reflection, feedback, and policy updates informed by results.

What Happens If Employees Fail Multi-Channel Phishing Simulations Repeatedly?

Repeated failures are diagnostic information, not character defects. They signal that additional support or different controls are needed.

When someone fails multiple simulations, investigate the underlying causes:

Workload and stress: Are they drowning in legitimate urgent requests and can't carefully analyze every communication?

Process gaps: Do they lack clear procedures for verifying unusual requests?

Authority pressure: Are they junior employees hesitant to question apparent executive directives?

Role vulnerability: Does their position inherently involve high-risk activities like payment processing?

Use results to guide one-to-one coaching and technical control implementation. The procurement specialist might need a verification checklist. The executive assistant might need explicit permission to use callback verification regardless of apparent urgency. Your payment workflow might need two-person approval above certain thresholds.

Technical controls should adapt to demonstrated risk. Employees who struggle with payment fraud simulations might need stepped-up verification requirements for sensitive transactions. This recognizes that humans have varying resilience to social engineering and adjusts defenses accordingly, reducing dependence on perfect human performance.

How Does Multi-Channel Phishing Testing Improve Resilience Against Deepfake and Vishing Attacks?

Safe exposure under controlled conditions builds recognition patterns. When employees experience realistic vishing simulations and deepfake scenarios with immediate educational feedback, they develop mental models for these attack types.

Consider voice cloning attacks. The first time someone encounters a synthesized executive voice on a call, they're likely to comply without question. But if they've experienced that same scenario in a simulation, they're more likely to recognize the situation and apply verification protocols.

Multi-channel testing also reveals process vulnerabilities that training alone can't fix. If simulations consistently succeed because your payment workflow lacks verification steps, you've identified a systems problem. The solution might be:

Automated callback verification systems for unusual payment requests

Mandatory two-person approval for transactions above certain amounts

Voice biometric authentication for sensitive phone-based approvals

Behavioral analytics that flag unusual payment patterns

Organizations refine incident response playbooks based on simulation outcomes. When a vishing simulation succeeds, do employees know who to contact immediately? Does the SOC have clear escalation procedures? Testing these processes under controlled conditions prevents chaos during real incidents.

What's the Goal of Integrating Digital Footprint Analysis with Phishing Simulations?

Combining OSINT with phishing simulations creates powerful learning moments that generic templates can't match. When employees see how their actual exposed data translates into convincing attack scenarios, awareness shifts from abstract to immediate.

Traditional training says "attackers research targets." Digital footprint integration shows employees their specific vulnerabilities:

"Your work email appeared in three data breaches with exposed passwords"

"Your LinkedIn posts reveal project details that could enable convincing spear phishing"

"Your voice from conference recordings could be used for AI cloning"

This personalization serves multiple purposes. It makes simulations more realistic by using actual reconnaissance data attackers would find. It motivates employees to reduce their exposure through remediation like changing compromised passwords and limiting public information. And it helps them understand the concrete connection between their digital footprint and organizational risk.

Security teams gain actionable intelligence. If 60% of your finance team has compromised credentials in breach databases, that's a specific, measurable vulnerability requiring immediate attention beyond training. Brightside AI's approach of combining simulation with active remediation addresses both the awareness gap and the underlying exposure simultaneously.

How Does Multi-Channel Phishing Training Support Board-Level Risk Narratives and ROI Cases?

Executives understand financial risk and business impact. Multi-channel phishing tools generate metrics that connect security activities to business outcomes, though the relationship is nuanced.

Build your board-level narrative around concrete observable improvements rather than guaranteed prevented losses:

"Our multi-channel phishing program reduced failure rates among finance staff from 31% to 12% over six months, while reporting of suspicious communications increased 180%. We've implemented technical controls based on identified process vulnerabilities, including mandatory two-person approval for new vendor additions and automated callback verification for payment changes. These improvements reduce our exposure to Business Email Compromise attacks, which averaged $129,000 per incident across reported cases in 2024."

This framing is honest about what you can measure (behavior changes, process improvements, technical controls implemented) while acknowledging that predicting prevented incidents involves assumptions about attack frequency and success rates that vary significantly across organizations.

Platforms like Brightside AI provide vulnerability scores and exposure metrics that quantify risk in concrete terms. Instead of "employees need more training," you can report "428 employees have compromised credentials in dark web databases, representing authentication risk we're systematically remediating".

When presenting to executives, demonstrate how the program identifies actual vulnerabilities in your specific environment. Show them their own digital footprints and exposure to make the risk immediate and relatable. This personal connection makes abstract cyber risk tangible for decision-makers who may not fully grasp the threat landscape.

Moving from Theory to Action with Multi-Channel Phishing Tools

Prioritizing Concrete Next Steps for Security Leaders

Email-only phishing simulations no longer reflect how sophisticated attackers operate. Coordinated campaigns targeting the same employees across inbox, phone, and video require defense strategies that match this multi-touch reality.

Start with a phased implementation roadmap:

Phase 1 (Months 1-3): Foundation

Deploy realistic email phishing simulations across all employees

Establish baseline failure and reporting rates

Implement "report phishing" buttons and triage processes

Identify high-risk roles and workflows

Phase 2 (Months 4-6): Risk-Based Targeting

Add vishing simulations for finance, procurement, and executive support

Use personalization to increase relevance for high-risk scenarios

Map vulnerabilities to specific workflows and processes

Begin implementing technical controls based on identified gaps

Phase 3 (Months 7-9): Advanced Threats

Pilot deepfake simulations for payment authorization roles

Coordinate multi-channel scenarios (email followed by vishing)

Integrate results into Zero Trust policies and access controls

Refine incident response procedures based on lessons learned

Phase 4 (Months 10-12): Integration and Optimization

Link simulation data to automated risk-based access controls

Calculate measurable improvements in failure rates and reporting behavior

Adjust technical controls based on demonstrated vulnerability patterns

Build board-level narrative around risk reduction and process improvements

This progression builds capability systematically while maintaining employee trust and organizational support. Each phase generates data that informs the next, creating a continuous improvement cycle.